CHAPTER 4: Oracle Apps Order to cash(O2C) Cycle

CHAPTER 4: Oracle Apps Order to cash(O2C) Cycle:--

If you want to go back and make any changes to line item after complete also but before create accounting, you can do that by just clicking on

incomplete button it will uncheck the complete checkbox and make any changes and then again click on complete button.

Now go to tools->create accounting>create final accounting

Go to tools>view accounting, you will receive 1000rs towards revenue account, 30 and 85 rupees towards freight and tax accounts respectively.

Creating a transaction doesn’t mean that we received the payment for that we have to create a receipt.

2.)Now we will create a credit memo against the original standard invoice, two ways navigation:--

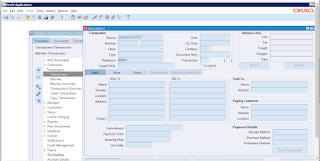

Nav:receivables>Transactions>Transactions

Or

Nav:receivables>Transactions>Credit Transactions

In credit memo, we are decreasing the amount of original invoice(5000) by creating credit memo invoice having negative amount(refund amount=1000) which will apply against the original invoice so that customer need to pay less amount that is 4000.(Negative sign)

Nav:receivables>Transactions>Credit Transactions, give the Transaction number=1001 and source name and click on find

Fill the required fields give the source name and click on Credit Lines button

And then click on freight if freight reduction also needed.

Save and come back to header window, will see the credit memo number generated under credit memo section

Now click on complete for validation

Create accounting.

Create final accounting, view accounting

Now check in transaction>transaction—balance due—details

To see the days late, nav:receivables>account details

Give the transaction number and find will get below info,

Receivables-> transactions-> transactions, query with Source and reference field combination

create accounting

go to tools ---> create accounting

choose the final Accounting mode

After the creation of the accounting is successful, you will receive a notice.

If you want to go back and make any changes to line item after complete also but before create accounting, you can do that by just clicking on incomplete button it will uncheck the complete checkbox and make any changes and then again click on complete button.

Now go to tools->create accounting>create final accounting

Go to tools>view accounting, you will receive 1000rs towards revenue account, 30 and 85 rupees towards freight and tax accounts respectively.

If there are any issues, we may look them up in the xla accounting errors database by selecting * from xla accounting table or, choosing Tools ---> look at accounting

review the accounting entries

Accounting entries

DR------------------- Receivables

CR -------------------revenue and tax

Tables –

about this page >Business component Reference details> choose the view object

xla_ae_headers h, ae=accounting entry

xla_ae_lines l,

xla_events e,

xla_transaction_entities,

xla_distribution_links,

xla-sub ledger accounting

copy transaction number and go to receipts:--

STEP 6: After invoice creation, Receipts creation: here we will create the receipt

Navigation : Receivables(responsibility name)->Receipts-->Receipts

enter the payment methods as manual, receipt number(give any user defined number), receipt Amount(from transactions window) in Receipt section

and enter transaction number, under the identify By section, as shown below

Now click on apply

Now save the below i.e cash receipt window

Example:-- item=11111(on hand quantity=80)

so=69503=reference

source =ORDER ENTRY

AMOUNT=25,000.00

DELIVERY_DETAIL_ID='6257051'

DELIVERY_ID=6271831

invoice number=transaction number=10047640

receipt number=121212123

now go to toolscreate accounting final accounting

tools-> view accounting, dr=receivables , cr=revenue

Again go to toolscreate accounting final accounting

tools-> view accounting, dr=cash , cr= receivables -- here your company will recieve an amount

If you want to go back and make any changes to line item after complete also but before create accounting, you can do that by just clicking on

incomplete button it will uncheck the complete checkbox and make any changes and then again click on complete button.

Now go to tools->create accounting>create final accounting

Go to tools>view accounting, you will receive 1000rs towards revenue account, 30 and 85 rupees towards freight and tax accounts respectively.

Creating a transaction doesn’t mean that we received the payment for that we have to create a receipt.

2.)Now we will create a credit memo against the original standard invoice, two ways navigation:--

Nav:receivables>Transactions>Transactions

Or

Nav:receivables>Transactions>Credit Transactions

In credit memo, we are decreasing the amount of original invoice(5000) by creating credit memo invoice having negative amount(refund amount=1000) which will apply against the original invoice so that customer need to pay less amount that is 4000.(Negative sign)

Nav:receivables>Transactions>Credit Transactions, give the Transaction number=1001 and source name and click on find

Fill the required fields give the source name and click on Credit Lines button

And then click on freight if freight reduction also needed.

Save and come back to header window, will see the credit memo number generated under credit memo section

Now click on complete for validation

Create accounting.

Create final accounting, view accounting

Now check in transaction>transaction—balance due—details

To see the days late, nav:receivables>account details

Give the transaction number and find will get below info,

Receivables-> transactions-> transactions, query with Source and reference field combination

create accounting

go to tools ---> create accounting

choose the final Accounting mode

After the creation of the accounting is successful, you will receive a notice.

If you want to go back and make any changes to line item after complete also but before create accounting, you can do that by just clicking on incomplete button it will uncheck the complete checkbox and make any changes and then again click on complete button.

Now go to tools->create accounting>create final accounting

Go to tools>view accounting, you will receive 1000rs towards revenue account, 30 and 85 rupees towards freight and tax accounts respectively.

If there are any issues, we may look them up in the xla accounting errors database by selecting * from xla accounting table or, choosing Tools ---> look at accounting

review the accounting entries

Accounting entries

DR------------------- Receivables

CR -------------------revenue and tax

Tables –

about this page >Business component Reference details> choose the view object

xla_ae_headers h, ae=accounting entry

xla_ae_lines l,

xla_events e,

xla_transaction_entities,

xla_distribution_links,

xla-sub ledger accounting

copy transaction number and go to receipts:--

STEP 6: After invoice creation, Receipts creation: here we will create the receipt

Navigation : Receivables(responsibility name)->Receipts-->Receipts

enter the payment methods as manual, receipt number(give any user defined number), receipt Amount(from transactions window) in Receipt section

and enter transaction number, under the identify By section, as shown below

Now click on apply

Now save the below i.e cash receipt window

Example:-- item=11111(on hand quantity=80)

so=69503=reference

source =ORDER ENTRY

AMOUNT=25,000.00

DELIVERY_DETAIL_ID='6257051'

DELIVERY_ID=6271831

invoice number=transaction number=10047640

receipt number=121212123

now go to toolscreate accounting final accounting

tools-> view accounting, dr=receivables , cr=revenue

Again go to toolscreate accounting final accounting

tools-> view accounting, dr=cash , cr= receivables -- here your company will recieve an amount

Awesome Content

ReplyDelete